The Data Point to Recovery, But Not for Every Company

The first six months of 2021 have brought significant change to the overall public health and economic climate. The last MMI, published in January 2021, signaled the early stages of optimism with the rollout of vaccines and the light at the end of COVID-19 tunnel. While it appears the official end of the pandemic is not yet near, the continued upswing in optimism, performance, and outlook for middle market companies is promising.

The National Center for the Middle Market has been keeping track of how the middle market has performed for nearly 10 years. The past 16 months required us to monitor COVID-related impacts. Compared to the darkest conditions of Q2 2020, mid-size executives are currently feeling much better about their company performance as well as the road ahead.

Revenues Have Recovered to Pre-Pandemic Levels

A Note of Caution

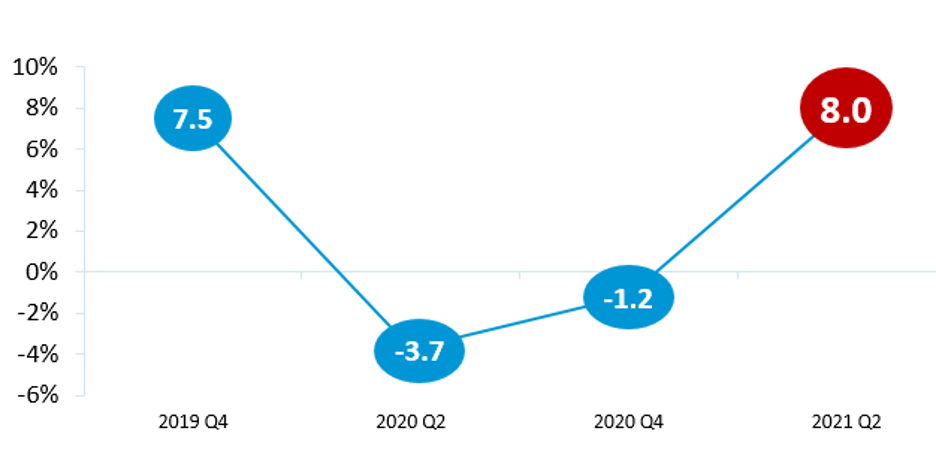

Since the MMI was launched in 2012, the historical year-over-year growth rate has hovered just below 7% (2020 excluded). Where the last two surveys resulted in average DECLINES for the first time in MMI history, that trend has now reversed with an average top-line revenue growth rate of 8.0% for the past 12 months. However, a note of caution exists as this does not represent true growth, but rather recovery; the numbers reflect growth since Summer 2020 when the floor had dropped, so to speak. Nevertheless, the projections offer an encouraging sign of a return to normalcy in the Middle Market.

A TALE OF TWO MIDDLE MARKETS

A closer analysis of this quarter’s data reveals a significant insight – middle market performance, and subsequent recovery, has not been equal across the board. Less than half of middle market businesses are experiencing 10%+ growth over last year, both in top-line revenue and related hiring, while a portion of companies remains stagnant and yet another segment has continued to struggle.

Rather than classify these groups in traditional ways (Growers vs. Non-Growers, Leaders vs. Laggards), the Center prefers to categorize these distinctions as Recovering (45% of companies) and Not Recovered (21% of companies).

Clearly, for the Not Recovered set of companies, the long-term impacts from the pandemic are drastic.

Recovering Businesses

The profile of recovering firms is clear. They tend to concentrate in business services, financial services, and manufacturing sectors, although there isn’t much difference geographically across different regions of the country. Recovering companies have strong and effective senior leadership, as well as a higher focus on investing in R&D and entering new markets along with a commitment to controlling costs. Interestingly, over 50% of the recovering companies have some level of private equity ownership. These leaders also have fewer concerns about lingering impacts from the pandemic, with the notable exception of supply chain issues.

Not Yet Recovered Businesses

Those companies yet to recover paint quite a different picture. To no surprise, they tend to be retail and healthcare firms, and given the restrictions and shutdowns over the past year, it will be interesting to see how a return to normalcy will benefit these industries. These businesses are clearly not as effective at managing their costs or retaining key talent in the organization. They are also less focused on R&D and new market expansion, understandably so given overall revenue declines since Q2 2020. Long-term COVID-19 impacts will continue to linger over these businesses, particularly in business operations and customer demand.