The end of 2021 finds the middle market in a much different position than at any other time since the pandemic began in March 2020. When we last reported on performance and sentiment during the past summer, results had improved, but the recovery was noticeably split between strong performers and those still languishing. Six months later, the story is much different as a vast majority (78%) of middle market firms are doing better now than at the end of 2020; many even say they are stronger now than they were pre-Covid.

The record-high results, on-going optimism, and optimistic forecasts are a result of shifting investments in digital technology as well as innovation in new products and services. As we’ve seen before with the “Mighty Middle,” the proper agility and resilience to shift gears has generated opportunities we see being leveraged across different industry sectors. It will be interesting to see whether current headwinds in the macro-economic environment (inflation, workforce, supply chain) decelerates performance, or whether, yet again, this segment forges ahead unscathed.

A MORE UNIVERSAL RECOVERY……AND AGGRESSIVE PROJECTIONS

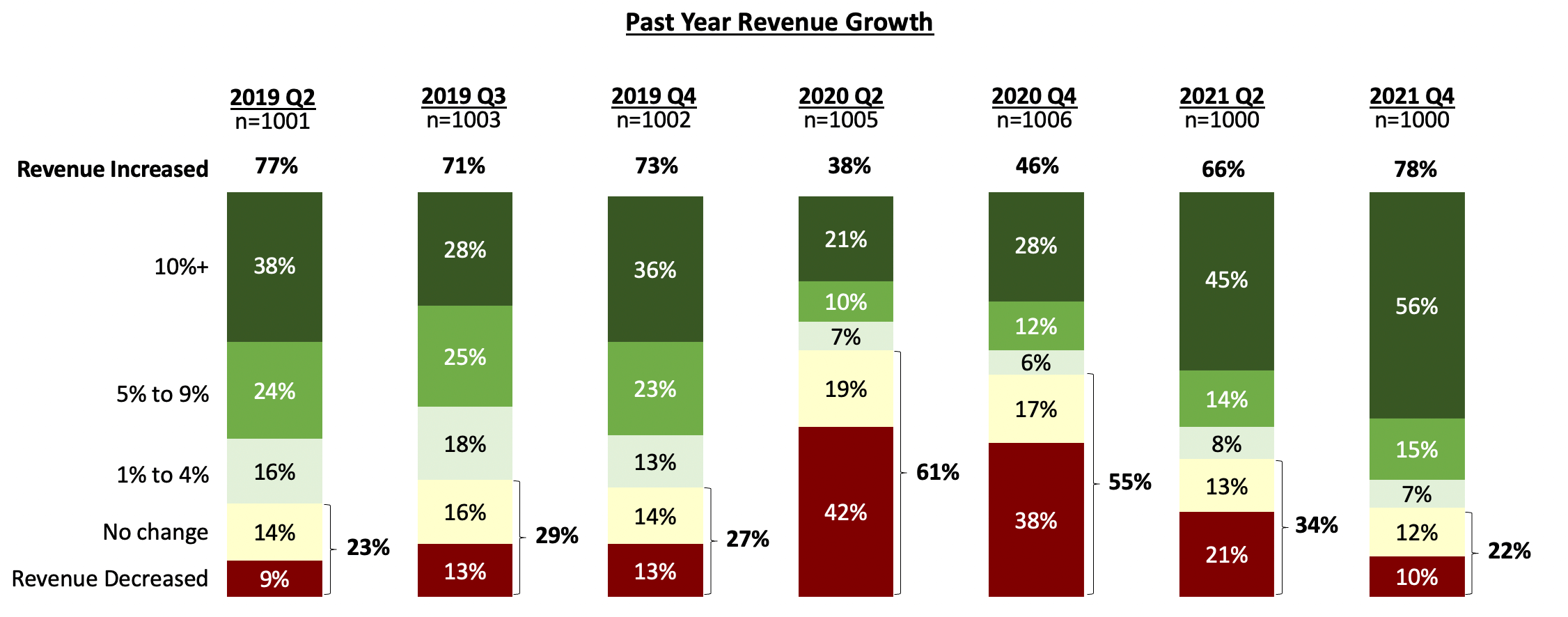

The strongest indicator of a more universal recovery across the middle market is the degree to which revenue growth is being reported broadly. Since the depths of the initial pandemic shock in summer 2020, the share of companies reporting positive year-over-year revenue growth continues to rise, while the percentage of those either holding flat or declining has fallen sharply over time. Acknowledging that the comparison is against the depths of 2020 year-end, over half of the middle market says their revenues have increased 10% or more since then. On the other end of the spectrum, only 10% of companies report any revenue drop throughout the year, on par with historical results.

The strongest indicator of a more universal recovery across the middle market is the degree to which revenue growth is being reported broadly. Since the depths of the initial pandemic shock in summer 2020, the share of companies reporting positive year-over-year revenue growth continues to rise, while the percentage of those either holding flat or declining has fallen sharply over time. Acknowledging that the comparison is against the depths of 2020 year-end, over half of the middle market says their revenues have increased 10% or more since then. On the other end of the spectrum, only 10% of companies report any revenue drop throughout the year, on par with historical results.

Perhaps even more promising are the robust projections for 2022. The projected revenue growth rate of 9.9 percent is the highest we’ve ever seen. Similarly, the employment growth rate is projected to remain in the double-digits for the upcoming year (10.3 percent). We focus a bit more on projections versus actuals in our spotlight section for this wave, but clearly, the middle market is poised for a sustained rebound.

NOT IMMUNE FROM SUPPLY CHAIN DISRUPTION

The second half of the year was dominated by stories of supply chain chaos, container ships floating outside of ports, and the threat of empty store shelves for the holidays. Through the course of the pandemic, certain categories experienced issues—no one will soon forget the run on toilet paper, cleaning supplies, and certain foods. However, with the growing complexity and global nature of many company supply chains, it is clear the middle market is in no way exempt from the issues.

Over the course of 2021, perspectives regarding supply chain disruption changed significantly. The percentage of companies saying supply chain risk was extremely challenging to manage jumped from 27% at the end of 2020 to 48% 12 months later. Nearly half of middle market companies (47%) said they have been impacted by supply chain disruptions in the past six months, not surprisingly this is most prevalent for manufacturing and construction companies. The most difficult aspects include service disruptions, complexity, and size and scale. Perhaps most importantly, 83% of businesses reporting supply chain issues said the disruption affected 2021 revenue, and 78% expect 2022 revenue to be at risk as well. Some of the typical management tactics to address these challenges have been increasing inventory and safety stock, as well as evaluating a mix of suppliers instead of a single source.

IT’S STILL ABOUT PEOPLE

While national unemployment has returned to near-record low levels seen in 2019, there are still millions of unfilled jobs across companies of all sizes and industries. Nearly 30% of middle market companies say their current workforce is insufficient for market conditions (projected growth, expected demand, etc). This is most acutely reflected in healthcare, as well as construction.

One of the Center themes for the past year has been the importance of digital transformation in the middle market. Unfortunately, four in10 companies say they have a digital skills gap (with two-thirds of these companies saying it is substantial). Among the challenges cited were a lack of qualified candidates in their specific geographic area, competition from other companies, and lack of resources (financial and expertise) to develop their people internally. Without addressing these challenges, the full benefits of the digital journey—et alone aggressive hiring projections – will unfortunately fail to come to fruition.