New Year, New Opportunity

As we begin 2021, it’s safe to say that no U.S. business has been spared the effects of the COVID-19 pandemic. From uncertain market conditions, industry-specific restrictions, and a stay-at-home workforce, the accelerants brought on by this crisis have touched almost every aspect of our lives and affected all companies – large enterprises, small businesses, and certainly the middle market –to some degree or another.

The Center has been keeping close track of how the middle market has fared over the past 10 months. We began with a “pulse” of 260 businesses in March 2020. We then we conducted a full MMI check-in last July followed by a second full survey in December 2020, continuously monitoring the progression of the new reality for businesses along with the response from middle market leaders. We saw the bottom drop out, and then, slowly, many businesses started making their way back over the summer, beginning a recovery that will most likely take much longer than anyone initially expected. Through all of this, we see the middle market doing what it does best—methodically overcoming challenges, leveraging core competencies, and maintaining a can-do attitude, adapting as necessary and taking a cautious approach to the future.

REVENUES PLUNGE, BUT THE FUTURE APPEARS BRIGHTER

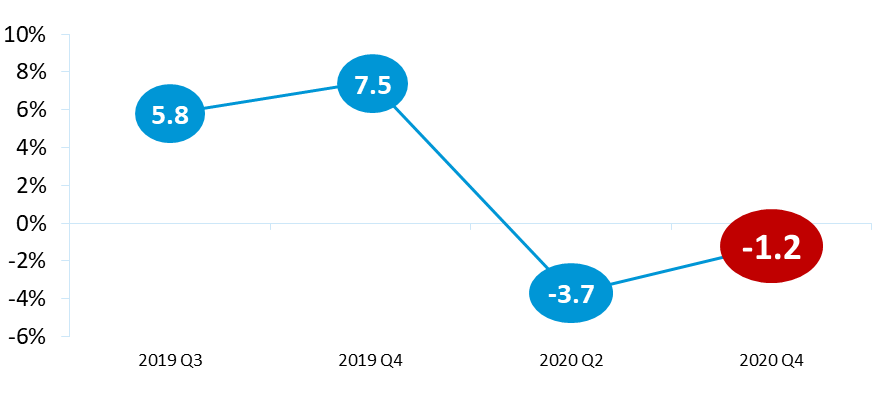

Since emerging from the last financial crisis (2007– 2009), middle market companies have consistently grown revenues, averaging 7.0% topline growth from 2012 through 2019. Just three months into the current pandemic, the hit was already severe. We witnessed the first negative year-over-year revenue rate in MMI history at -3.7%.

However, the worst of the storm may have passed. The latest data show revenue decline of

-1.2% for 2020—still negative, but not as dire as the June 2020 data. And projections for 2021 revenue growth are 4.1%, a better outlook than six months ago. Note that these cautiously optimistic forecasts are bifurcated: just 44% of firms expect revenue to grow while the rest expect no change or continued declines in the year ahead.

Industry Differences

The Center continues to look at various indicators by industry sector to understand differences across the heterogeneous makeup of the middle market. Given changes in consumer spending and the consequential shift to online transactions that put some businesses in a bind, it’s not surprising that retail trade (which includes restaurants) continues to lag, reporting revenue decline at -3.8%. Similarly, employment declines are the worst for this sector at -3.4%. In addition, construction results plunged from our last survey, with declines for both revenues and employment at -3.1% for this group for the year.

On the flip side, other industries have prospered. Professional services – law firms, accountants, business services – appear to have weathered the disruptions well, due in part to the inherently remotely accessible nature of their work, making their businesses somewhat immune to the impact of social-distancing guidelines. The services industry grew revenues at nearly 3.0% and employment at 1.7% during 2020.

Now What?

Many economists have echoed the statement “no recovery without a vaccine”. Now that we see these remarkable protections coming to fruition as another tool to combat the virus, will more consumers be comfortable to travel, dine in restaurants, and head back to work? Will more businesses move forward with investments for growth such as facilities, IT, and training? Will digital transformation continue to accelerate as a necessary response to environmental conditions and customer requirements?

While no one could have forecasted how 2020 played out, it will be fascinating to follow the long road to recovery in 2021, and to witness and unpack the role that middle market companies will surely play in leading the effort.