The following article appeared in the September 2014 edition of Middle Market Growth magazine, a publication of the Association for Corporate Growth.

A recent survey of middle-market companies says nearly two out of three business executives (61 percent) rate innovation of new products, services, or processes in their organization as highly or somewhat challenging. Thankfully, according to soon-to-be-released research from the National Center for the Middle Market, these companies need only look to their peers and competitors to learn what they can do to become more innovative.

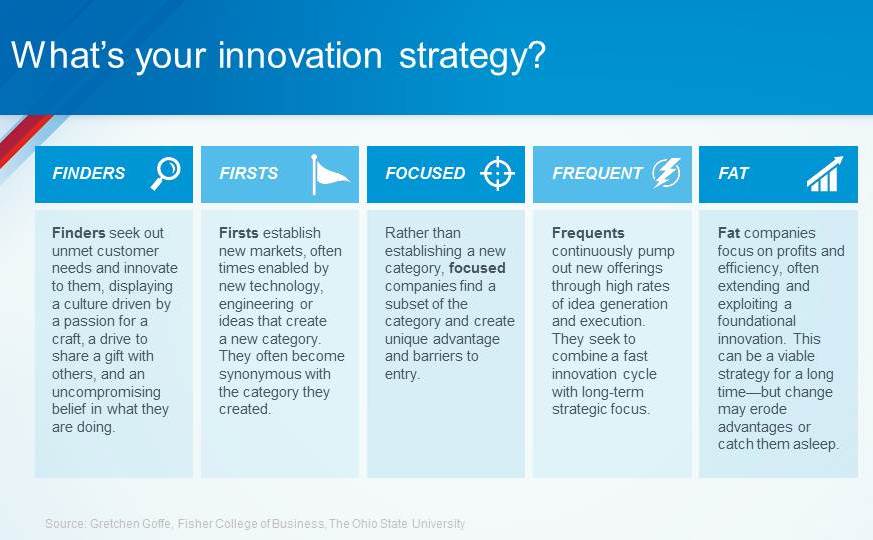

This research proves yet again that the middle market is a distinct market segment, not simply a blend of its small and large counterparts. Unlike startups, which have flat organizations where nearly all employees play a role in developing a handful of projects, or large corporations, which fund large innovation groups and multiple programs simultaneously, middle-market companies organize their teams in five distinct ways, called typologies, which are unique to this sector. They are outlined below:

- First companies establish new markets with little or no competition and have the ability both to create value and capture it. In their relentless pursuit to be first in a new market, they are particularly adept at looking at their core product or service and identifying new ways of entering adjacencies. A great example is Vitamix, a manufacturer of high-performance blenders, which operates in the consumer space and has expanded into food service with corporate clients like Jamba Juice, Starbucks, and McDonalds.

- Fat businesses are content with the status quo. They have successful products or services, usually with healthy profit margins, and typically do not invest time or resources to improve them. This typology is often seen in family-owned businesses, particularly with the second or third generation of owners when more family members rely on the company and view innovation as a drain on the bottom line.

- Fast firms let their "first" counterparts assume the risk of proving a market opportunity and then respond quickly with a competing product or service. They benefit from having smaller research and development teams and often compete on price in head-to-head comparison marketing. This typology thrives in areas where there are little to no intellectual property protections or barriers to entry.

- Finder companies seek opportunities that have been overlooked or where others have failed. They are experts at identifying unarticulated customer needs and shaping them in new ways through design, functionality and marketing. A great example is Rent the Runway, a service for renting designer gowns and accessories. The midsized business successfully identified an unmet need in the apparel space and created an offering for high-fashion, cost-conscious consumers.

- Frequent businesses continually innovate because their business model compels them to. These companies are often found in the fast food and retail industries, where new offerings are required to stay ahead of competition; however, the rapid pace of innovation may inhibit their ability to maintain long-term strategic focus. Exemplifying this typology is the fast-casual restaurant Noodles & Company, a thriving middle-market business that refreshes its seasonal dishes for a growing customer base.

What can middle-market companies learn from these typologies?

First, assess where your company is today. Which typology do you most identify with? How do you compare with your competitors?

Next, determine which typology, or mix of typologies, can give you an advantage. Is your company in a short- or long-cycle industry? Could you benefit from shorter or faster cycles?

Third, identify how you organize your company around innovation. If you want to shift direction, how would you allocate resources differently? What impact would that have on leadership and skills?

And finally, keep an eye out for the official release of the research from the National Center for the Middle Market later this year, which will include a tool kit to help middle-market companies be more innovative.

Gretchen Goffe is executive director for the Innovation Initiative at The Ohio State University Fisher College of Business, and is a fellow of the National Center for the Middle Market.