Established businesses have a poor track record for embracing disruptive innovation or dealing with it if it threatens them. Too often they misread the environment, misunderstand their options, and misplay their hand. In this article we are going to dig into the forces involved, how they impinge on business strategy, what options a business has to respond, the pros and cons of those options, and finally how best to organize to execute one’s chosen response. It is specifically focused on mid-market enterprises in the $10 million to $100 million revenue range. Unlike venture-backed start-ups, these going concerns have something to lose, as well as something to gain, from embracing disruptive innovations. Unlike start-ups, they don’t have venture capital to carry them until their strategic investments pay off. Unlike their larger brethren, they don’t have the size to absorb the cost (or the write-off after a failure) or to experiment off to the side of their core business.

When a company in this range makes a big bet, it has to win it.

Needless to say, this causes many mid-market management teams to shy away from making any big bets. It is not just that there is a lot at stake—often our stakeholders are members of our own family, people we are loath to put at risk.

But risky as it may be to make a move, it is riskier still to stand still when converging technology advances are driving not just a new generation of IT infrastructure but also a raft of new operating models and business models. We might call this the “digitalzation” of everything, and wherever it takes hold, it is changing the dynamics of business radically and permanently. That’s because it is able to unleash enormous amounts of value that historically had been captured by middlemen or trapped in legacy systems and processes, money that can be reallocated along the value chain or passed onto the customer in lower prices and better service. Thus digital media led by Facebook and Google are displacing traditional media, Netflix is disrupting television, Airbnb is disrupting hospitality, Uber is disrupting transportation, and Amazon is disrupting retail. Meanwhile mobile software applications are transforming banking, air travel, car navigation, and will soon transform health care, social services, even agriculture and education. Can one really expect one’s own sector to be exempt?

For better or for worse, the answer is no. There is no reasonable chance that any sector of the economy can escape digital transformation sooner or later. Of course, there is a big difference between sooner and later. Despite claims to the contrary, nobody ever knows exactly when the next wave of change will land on a company’s shores. It comes down to making a bet. You can call it a strategic decision if you want, but don’t kid yourself. It’s a bet, and you need to make yourself as smart as you can about your options.

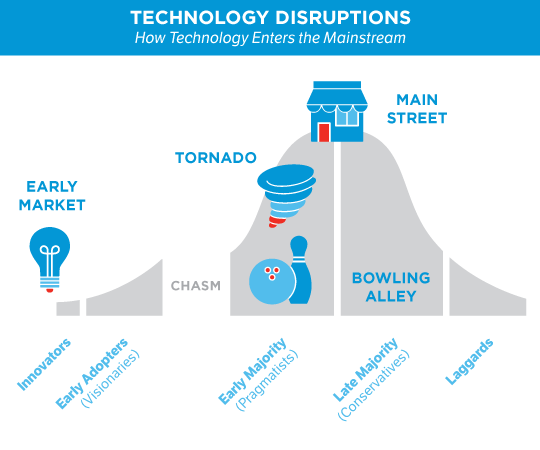

A well-established framework called the Technology Adoption Life Cycle can help you do this.

This framework is based on original work by Everett Rogers in the 1950’s that was adapted to the high tech sector by Regis McKenna in his seminal book, The Regis Touch, and modified to incorporate the chasm element in my first book, Crossing the Chasm. It highlights four inflection points in the adoption of a disruptive technology. Each one is associated with a different betting strategy, resulting in four distinct strategies that have, over time, proved successful at coping with disruptive innovation.

DISRUPTION CAN BE PLAYED IN DIFFERENT WAYS

Four Adoption Strategies

Go ahead of the herd for competitive advantage

Bespoke projects from the experts

Go ahead of the herd to address a painful problem

Proven applications from solution-focused vendors

Stick with the herd as it transitions to new infrastructure

Next-generation infrastructure from category leaders

Go after the herd for less disruption and a lower price

Evolutionary extensions from established vendors

You need to familiarize yourself with these strategies and socialize them with your colleagues, so that you and your team can choose one—and only one—to make your future-determining bet.

Here are the four betting strategies:

- Visionary. Adopt ahead of the herd, proactively embracing the disruptive innovation long before you are forced to. The return on this bet is differentiation, the goals being to create a competitive advantage gap between you and your competitive set and to acquire new customers. This is the bet that catapults new market leaders from out of nowhere, as Charles Schwab and eTrade did in personal investing, as H&M and Zara did in retail clothing, as Uber and Lyft are doing in transportation.

To execute this strategy you must commit to an early adopter program, enlisting both product vendors and service providers in a major project to build out the new system largely from scratch. This is a high-risk, high-reward proposition. As such it is normally chosen by venture-backed start-ups who have everything to gain and not a lot to lose. Conversely, it is rarely appropriate for a market leader that already has an existing competitive advantage to exploit.

For a mid-market enterprise, there are two times it should be considered. First, if you have access to an adjacent market where the existing leaders have been milking legacy advantages for a long while and are ripe for disruption, you can use this strategy to launch yourself into that new segment. This is what Apple did twice, first with digital music, then with smart phones. Second, if you have been languishing in a market pecking order in third, fourth, or fifth place, and are tired of fighting for scraps, you can use it to try to leapfrog the competition by redefining the whole value proposition in a way they simply cannot match. This is what Dell did when it used direct distribution over the Internet to jump over HP, IBM, and Compaq in the PC business. In both cases the risk is still high—you could lose your whole company if things turn out badly—but the rewards may be big enough to warrant the gamble.

- Pragmatist in Pain. Here you adopt ahead of the herd not for competitive advantage but to battle back against a direct attack from a disruptive challenger. The return on innovation here is neutralization, not differentiation, the goal being to co-opt some of the new player’s appeal while keeping established operations intact. This won’t win you many new customers, but it will allow you to keep your existing ones. That is what led San Francisco taxicab companies to adopt FlyWheel, a mobile software app that mimics Uber’s ability to summon, track, and pay for transportation directly from a smart phone. This is what is causing cable companies to offer Internet-enabled media options to keep Netflix at bay. People don’t like to switch, so if you are the incumbent, you have an advantage. But your customers need to see you making progress toward the future in order to stay loyal. If you rely on inertia to protect your franchise, it will erode before your eyes.

As noted, to execute this innovate-under-duress strategy, you must focus your efforts on neutralization, not differentiation. You are not trying to out-innovate or leapfrog the disruptive challenger, just to catch up to them. This is what Android smart phone vendors like Samsung did to catch up to the Apple iPhone, and sadly what Motorola and Nokia, the now-defunct then-market-leaders, failed to do. The goal is to get to good enough as fast as possible to co-opt at least some of the most attractive features of the newcomer, counting on your other virtues to keep the bulk of your customers loyal.

This is a medium risk, medium return endeavor, and really the only viable path when your sector has been directly attacked by a next-generation technology player. The good news is it is much easier to clone than to create. To do so, however, you must enforce a strict discipline that insists on copying, not inventing, not just because that is faster and cheaper, but because you are trying to commoditize your opponent’s crown jewels, not out-jewel them.

- Pragmatists with Options. Here you are adopting with the herd, neither for competitive advantage nor under duress, but because productivity gains are there for the taking. The return on innovation comes from modernization, the goal being to capture cost savings and exploit new tools (like analytics) without disrupting the momentum of your current business or putting mission-critical processes at risk. You are enhancing your operations on an evolutionary, not revolutionary, trajectory, in part because you have the time to do so, in part because this is the most profitable path.

In executing this strategy your best bet is to work with market-leading technology vendors and experienced systems integrators and follow proven implementation paths as closely as you can. This makes for a low risk, medium reward endeavor that is well suited to a mid-market enterprise. Success depends in large part on well-executed change management, something much easier to bring off at your size than in a mega-corporation. Well implemented, it should not only produce productivity returns but also vaccinate your enterprise against a future disruptive challenger. Absent other forces at play, this is your best bet and the default strategy of the four.

- Conservative. This is the fourth option to consider when making a technology adoption bet: Postpone it as long as possible. This is a perfectly reasonable option if you are not under duress to adopt, are not particularly comfortable with digital technology in general, and are in a business where digital advances come relatively slowly. Eventually you acknowledge you will convert to the new infrastructure when you expect it to be a well-debugged commodity that is relatively inexpensive to deploy. But for the time being you have better uses for your cash, time, talent, and management attention.

When you do implement, the return on innovation will come from optimization. Your goal will be to use technology to reduce costs with a minimum of disruption. In this context, you will want to work with an experienced managed services provider who can buffer you as much as possible from the actuality of technical implementation, ideally running your system in the cloud. This is a low risk, low return strategy, one that puts savings in your pocket and does not distract you from the other things you do to create value for your customers and investors. Your ultimate reward is to maintain the status quo and enjoy another year of business as usual.

Those are the four bets—visionary, pragmatist in pain, pragmatist with options, and conservative. As you can see, they are quite distinct from one another, each with its own rationale, its own risk/reward ratio, and its own critical success factors. Because they are mutually incompatible, it is imperative that you choose one and only one of the four approaches in order to engineer a successful outcome. It is always possible you will not make the best choice, but committing clearly to any one option gives you a better chance than vacillating between two or more.

About the Author

Geoffrey Moore is an author, speaker, and advisor who splits his consulting time between start-up companies in the Mohr Davidow portfolio and established high-tech enterprises, most recently including Salesforce, Microsoft, Intel, Box, Aruba, Cognizant, and Rackspace.

Moore has a bachelors in American literature from Stanford University and a PhD in English literature from the University of Washington. After teaching English for four years at Olivet College, he came back to the Bay Area with his wife and family and began a career in high tech as a training specialist. Over time he transitioned first into sales and then into marketing, finally finding his niche in marketing consulting, working first at Regis McKenna Inc, then with the three firms he helped found: The Chasm Group, Chasm Institute, and TCG Advisors. Today he is chairman emeritus of all three.