This post is the third in a series based on the research report Working Capital Management by the National Center for the Middle Market. It sizes up the financial opportunity for middle market companies that make improvements in working capital management practices. Download the full report here.

Most middle market companies are happy with their working capital management approach. They aren’t running out of money on a regular basis, so they aren’t highly motivated to change their practices.

But, as the Center’s latest research reveals, this contentment with the status quo could be causing companies to miss out on free cash that’s currently tied up in excess inventory or accounts receivables, or that’s paid out sooner than necessary to vendors and suppliers.

Just how much free cash?

One hypothetical example puts the number in the tens of millions of dollars. And that’s a figure that, most leaders would agree, shouldn’t be ignored.

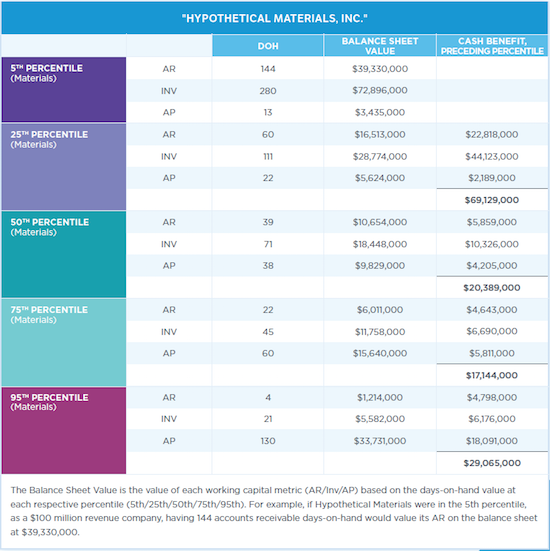

Our example shows the average company has over $20 million more in free cash than its peers in the 25th percentile.

To illustrate the financial opportunity associated with better working capital management practices, the Center assumed a company in the materials industry earning $100 million in annual revenues. Based on data for publicly traded middle market companies, if this company—we’ll call it Hypothetical Materials, Inc.—is in the middle of the pack compared to its peers on key working capital metrics, then it has about $10.6 million in outstanding receipts. And it can expect to collect that money over the next 39 days. However, if Hypothetical Materials were only in the 25th percentile, it would have about $6 million more tied up in accounts receivable (or $6 million less in the bank) primarily because it takes about 21 days longer to collect from customers.

From an accounts receivable perspective, as an average company, Hypothetical Materials takes longer to pay its bills than peers in the 25th percentile. As a result, Hypothetical Materials has a larger balance outstanding than those peers. But that means more cash currently in the coffers. Compared to businesses in the 25th percentile, which pay 16 days faster than average firms, Hypothetical Materials keeps about $4.2 million more cash on hand.

Finally, a look at inventory shows that as an average company, Hypothetical Materials has 40 fewer days of inventory on hand or in process than businesses in the 25th percentile. That translates into an additional $10.3 million in cash on hand, as opposed to being tied up in product.

Add it all up, and the difference between materials companies in the 50th and 25th percentile is over $20 million in free cash. That additional cash can go a long way toward making Hypothetical Materials a more agile, competitive, and successful organization.

Even minor improvements in working capital management can have a major financial impact.

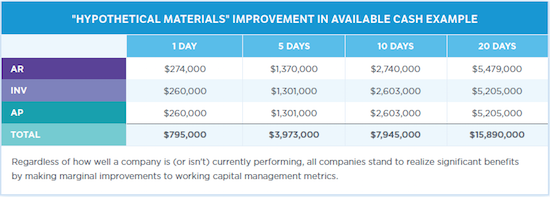

Obviously, collecting from your customers two months faster, paying your vendors two months later, or reducing inventory on hand by five months isn’t a change an organization can make overnight. But what if your business could collect just a few days sooner? Pay a few days later? Or reduce what’s on the shelves by a couple of days? Would these relatively small changes have much of an impact?

Turns out that the answer is a resounding “yes.” Again, looking at the public company data, in our Hypothetical Materials, Inc. example, improving all three metrics by just one day frees up $795,000 in cash. Improving by five days takes that number to nearly $4 million.

The bottom line? Even if you believe your company is doing quite well at working capital management, and even if you’re doing better than most of your peers, you still have a significant opportunity to free up considerable sums of cash by making moderate adjustments to your policy.

Start exploring your opportunity today.

To learn more about the financial impact of working capital management, and to see how businesses in different industries compare, check out the Center’s full research report, Working Capital Management: How Much Cash Is Your Business Tying Up?

Next in this series

Post 4: Find Free Cash: 6 Ways to Improve Working Capital Management

Others in this series

Post 1: Cash Is King: How Good Working Capital Management Practices Can Help You Get More of It.

Post 2: Your Working Capital Management Approach: Is Good Enough Really Good Enough?