The third post in a series based on the research report Middle Market M&A: What Executives and Advisors Need to Know to Make the Most of Mergers & Acquisitions, by the National Center for the Middle Market, this blog post explores the unexpected challenges faced by first-time dealmakers.

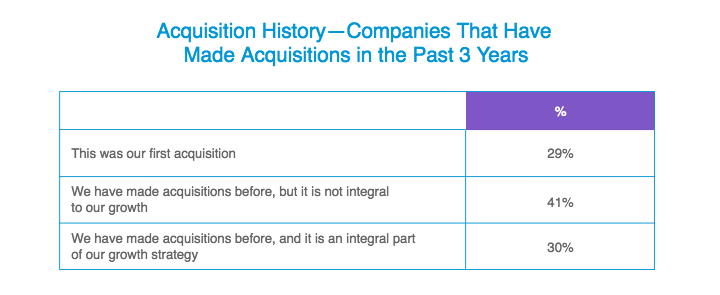

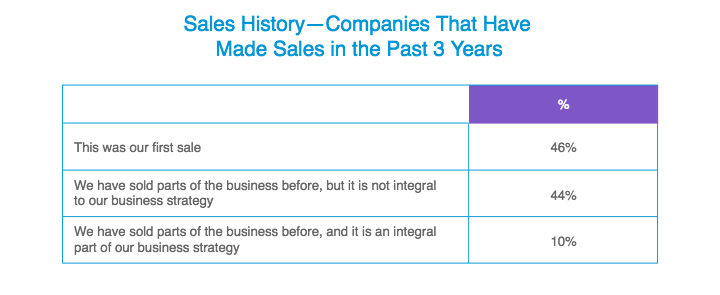

The National Center for the Middle Market’s latest research shows a strong rhythm of M&A activity in the middle market. In any given year, nearly one in four mid-sized businesses are engaged in either buying or selling all part of an organization. While some of these businesses are serial dealmakers, most are relatively inexperienced. In fact, among companies that bought or sold in the past three years, roughly 30% were doing their very first deal, and about 40% say they do deals infrequently.

In other words, most companies come to the table without a lot of previous deals under their belt. As a result, they are often met with unexpected challenges that can keep them from driving the best bargain or that can impede the success of both deal execution and post-merger integration.

Here are the biggest surprises first-timers faced:

- Integrating an acquisition is harder than it looks.

For buyers, the biggest challenge with M&A is post-merger integration. Nearly half (44%) of companies doing a recent deal rated integration as very or extremely challenging, and only about one out of five companies completed the integration process without facing any challenges at all. Sellers, too, cited integration as a key concern. Integration challenges come in many flavors. The issues can be operational, commercial, technical, and/or people-related. Executives found it challenging to merge two separate systems and servers. But they were equally challenged by assimilating two separate corporate cultures.

- Companies need to get better at assessing financials—their own and their potential partners’.

Assessing the value of a target came in number two on the challenges list for buyers, right behind integration issues. Valuations are often done by looking for comparable deals. Because the vast majority of middle market companies are privately held, publicly available data on which to base proper valuations can be hard to find, and you can't get target company data unless they agree to provide it. For their part, half of sellers complain that they were not fairly valued by buyers.

Because middle market companies tend to be highly dependent on a handful of customers and/or key employees, it’s even harder to calculate value and risk. Compounding these issues is the fact that for many middle market companies, bookkeeping and operational processes and systems may be informal and not as well-documented as a potential buyer would like. This translates into both buyers and sellers having to put in more effort in order to arrive at a fair valuation. (It also compounds the post-merger integration problems described above.

- Involving outside experts early can help.

To do a successful deal, companies need skills in due diligence (financial, operational, technical, cybersecurity, and talent-related), deal execution, and integration. That’s a lot to ask of mid-sized businesses that typically operate with lean staffs. Since most middle market companies participate in deals infrequently, they can’t justify the expense of maintaining these capabilities in-house. Most executives quickly realize they will need outside support to make their M&A plans successful. However, companies often make the mistake of waiting too long to get these experts involved in the process. Consulting lawyers, bankers, accountants, and others early in the process of searching for a target to acquire or a buyer to sell to can help companies approach M&A in a strategic manner from the get go, and may alleviate some of the challenges they face later in the process.

- It’s never too early to plan.

Both buyers and sellers resoundingly told us that they felt less than well-prepared for their latest deal. Considering that many businesses—21% of buyers and 45% of sellers—entered into their last transaction as the result of unexpected opportunity, this isn’t surprising. However, the research suggests that as many as half of middle market firms will eventually be involved in some type of M&A activity. So even if M&A isn’t on your horizon at the moment, it’s a good idea to invest some time in activities such as getting your books in shape, documenting processes, and getting to know the advisors with deal experience. These steps can help if you eventually do find yourself at the table. And even if you don’t, they still make good business sense.

See what else you should know about middle market M&A.

To find out more about M&A and how to best prepare for potential future deals, download the Center’s full report, Middle Market M&A: What Executives and Advisors Need to Know to Make the Most of Mergers & Acquisitions.

Next in this series

Post 4: Get Deal Ready: Be Prepared for the Right Opportunity

Others in this series

Post 1: Let’s Make a Deal: 3 Reasons Why the Time Is Ripe for Middle Market M&A

Post 2: It’s About Growth: M&A Is A Strategic Tool for Middle Market Companies Looking to Expand